Portfolio monitoring software

Portfolio monitoring software

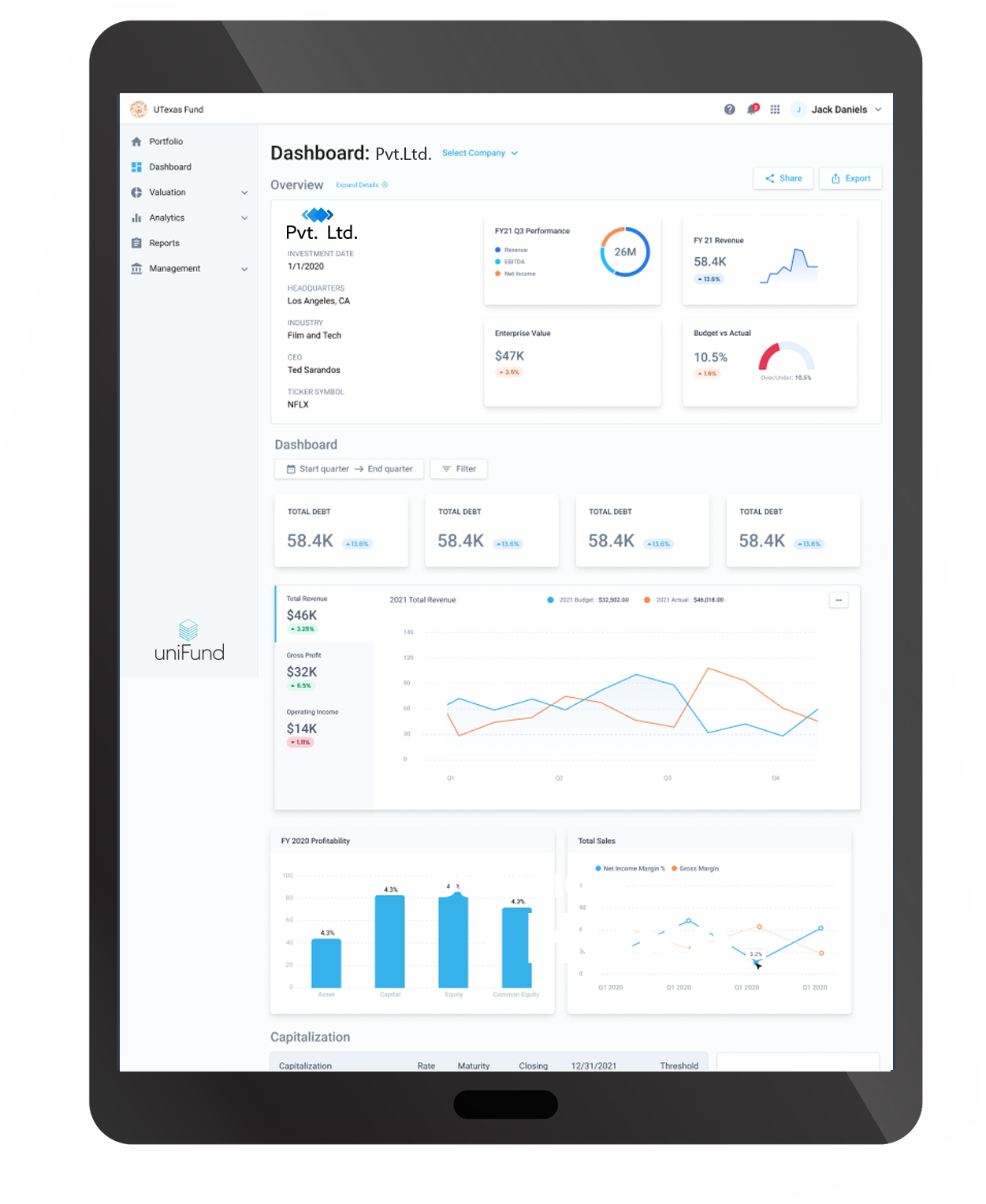

uniFund is a leading technology solution for the private market that enables users to capture, classify, analyze and report financial and operational data of portfolio companies.

uniFund optimizes business decisions in a cloud-based environment

One version of the true! Clear data, easy historical source, no difference

- Historical data retention

- Standardized data collection

- Effortless access to trends and KPIs

- Customizable dashboard

- Best-in-class reporting following industry standard

Secured cloud-based solution for fund managers

Data management

Capture, classify and centralize data from portfolio companies into a secured database. uniFund's data capturing process eliminates effort and stress by having flexible templates that are designed for our clients benefit

Portfolio management

uniFund enable users to quickly understand value drivers, compare performance to industry benchmarks, optimize decisions and generate quality reports.

Interactive dashboard ensure to access to relevant data in a clear, reliable and direct manner providing fund managers with an efficient solution for organizing and presenting key data in a concise way. uniFund allows users to quickly evaluate the up-to-date performance of portfolio companies.

Performance and investor reporting

Generate ILPA reports (or customized) for LPs and share them via your secured portal. Our performance simulator, allows you to estimate IRRs and MOICs.

uniFund user-friendly wizard guides the analyst through the process helping to understand when and where value is created for investors.